Bitcoin’s Correlation (or Lack Thereof) to the U.S. Dollar & Major Indices

As Bitcoin continues to mature as an asset, its correlation to the USD and major indices is being closely monitored. While Bitcoin was originally thought to be an uncorrelated hedge (i.e. a “digital gold” of sorts), in some cases it has become increasingly correlated to major U.S. markets (especially the Nasdaq, which is a tech-heavy index).

But what’s the reason for this progression? Let’s dive in!

Macro Factors

Macro drivers like interest rates, Fed policy, and inflation affect both traditional markets and Bitcoin. When rates go up, risk assets generally drop, which includes BTC. When rates fall or the Fed hints at potential easing, all of these assets tend to move upward together.

| Date | Fed Action |

Bitcoin Reaction |

|

3/19/25 |

Held Steady – potential 50 bps cut later in ‘25 | Up 5.2% |

|

1/29/25 |

Held Steady |

|

|

12/18/24 |

25 Basis Point Reduction – fewer cuts in ‘25 |

|

|

11/7/24 |

25 Basis Point Reduction |

|

| 9/18/24 | 50 Basis Point Reduction |

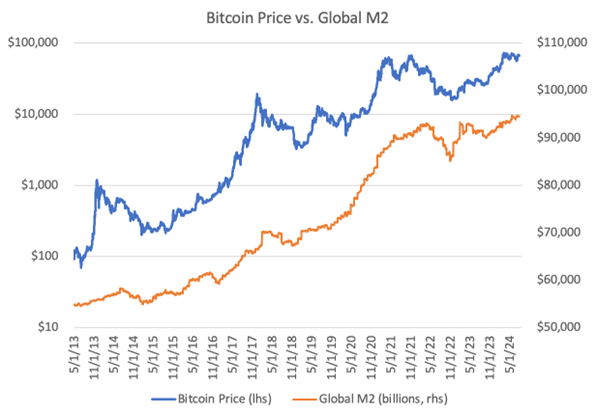

Liquidity Flows

Just like equities, Bitcoin is sensitive to global liquidity. When central banks inject liquidity, excess capital traditionally flows into speculative assets: tech, crypto, meme stocks, etc. When liquidity dries up, these same assets are generally the first to fall.

Global M2 is just one piece of the very complex puzzle that is global liquidity. Complication is magnified by the 13 week lag – meaning changes in M2 money supply today tend to impact economic indicators and asset prices (i.e., stocks, real estate, or inflation) about 13 weeks later. Shadow monetary base, or liquidity equivalents created by non-bank financial institutions (i.e., repurchase agreements, commercial paper, asset-backed commercial paper, and money market funds) must also be taken into account.

As global liquidity has been dropping recently, it may cause us to get a bit more defensive in the coming months.

Source: https://www.lynalden.com/bitcoin-a-global-liquidity-barometer/

Source: https://www.lynalden.com/bitcoin-a-global-liquidity-barometer/

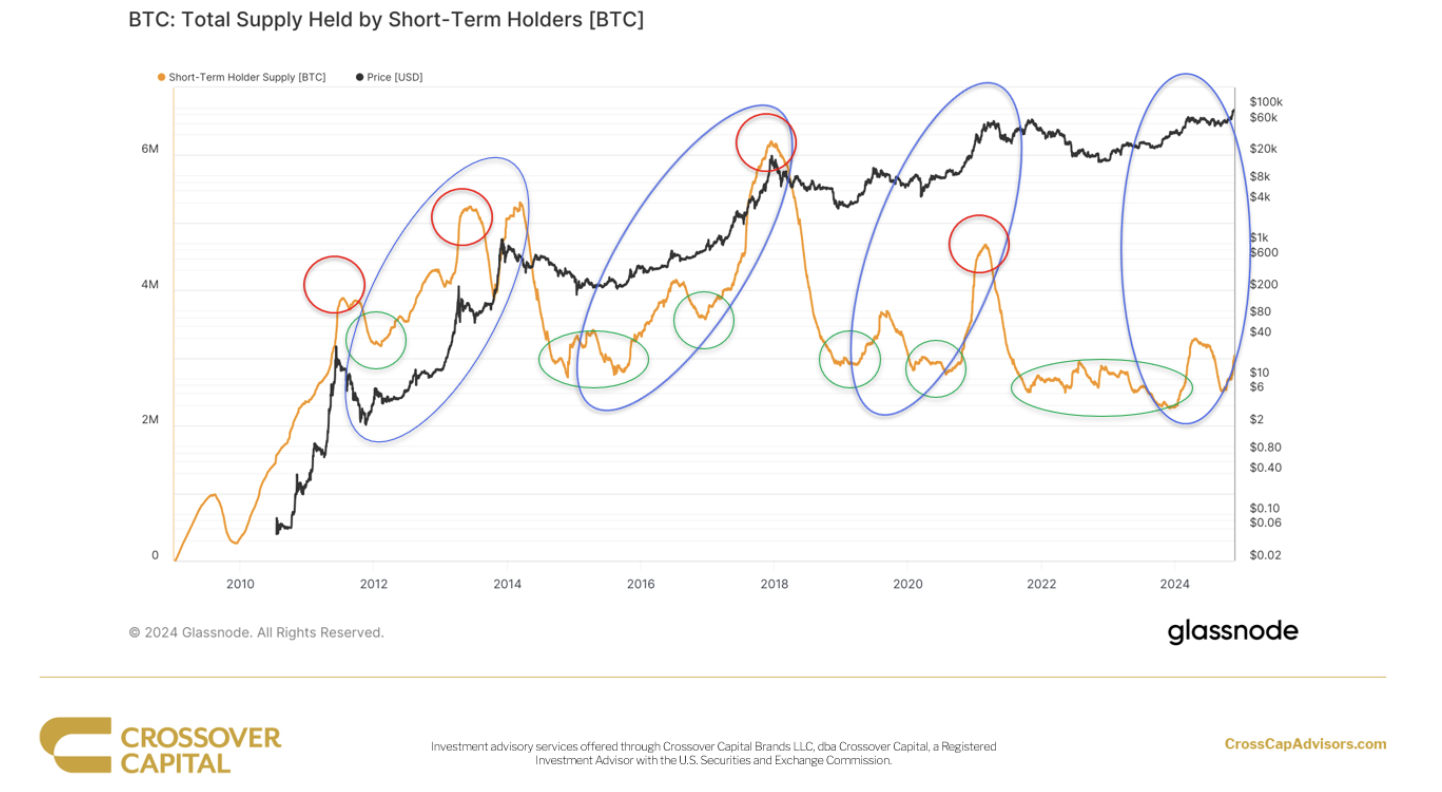

Retail Overlap

Many crypto traders also trade tech stocks, options, and meme stocks, so sentiment and psychology often overlap. This has a tendency to amplify the correlation during both bull runs and sell-offs.

As Ross Gerber, CEO of Gerber Kawasaki, said, “BTC price movements are related to sentiment. Risk on, up. Risk off, down.”

No Longer Solely a Potential Exit from the Traditional Financial System

Once thought of exclusively as a potential safe haven or an inflation hedge (like gold), the view of Bitcoin has changed over time. We believe investors are realizing that Bitcoin behaves less like gold, and more like a high-beta equity.

Source: https://newhedge.io/bitcoin/gold-correlation

Source: https://newhedge.io/bitcoin/gold-correlation

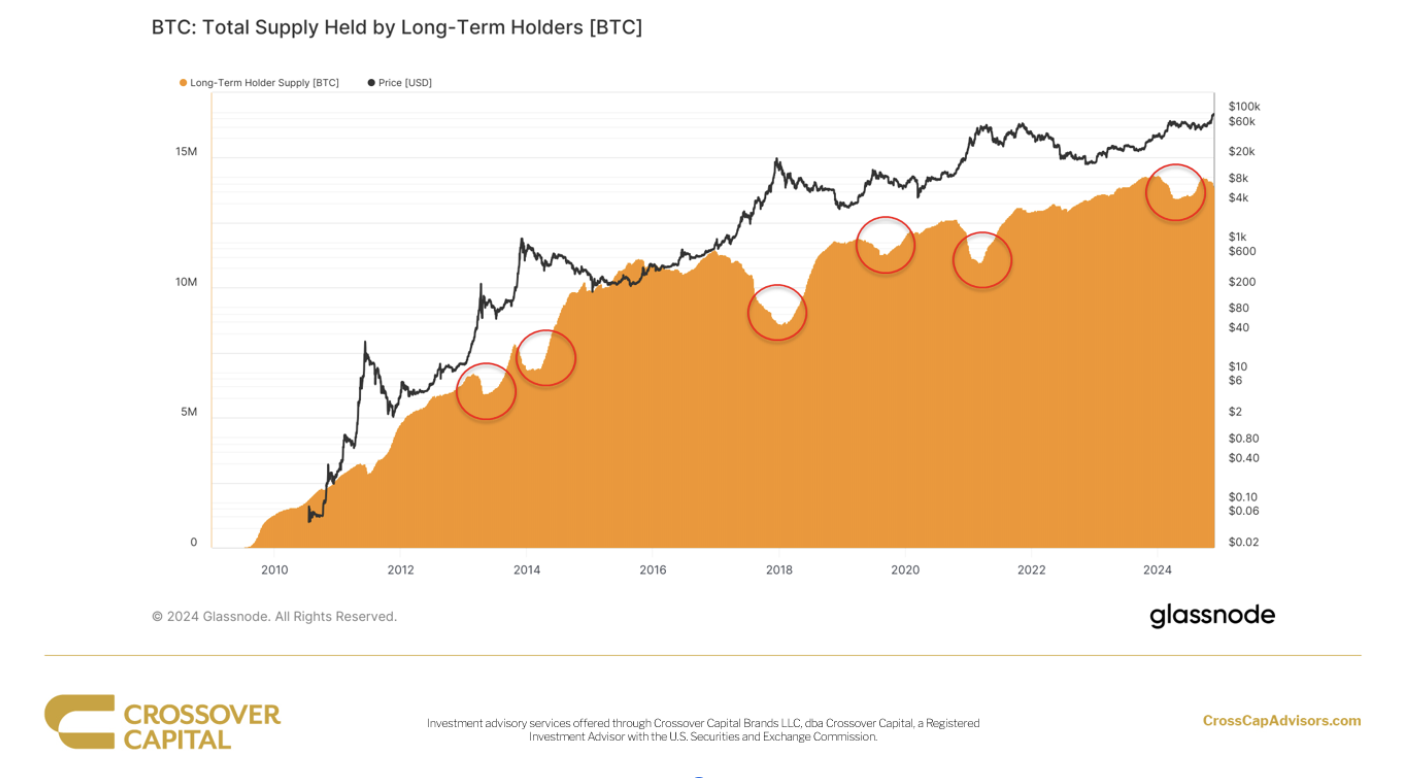

Institutional Adoption

As more institutions move into Bitcoin, many believe they will be less likely to sell and more likely to accumulate bitcoin in the same way that countries have previously tried to stack gold. This long-term investment thesis allows them to be less reactive than retail investors (which can be seen in the below charts).

Notable Instances of Inverse Correlation

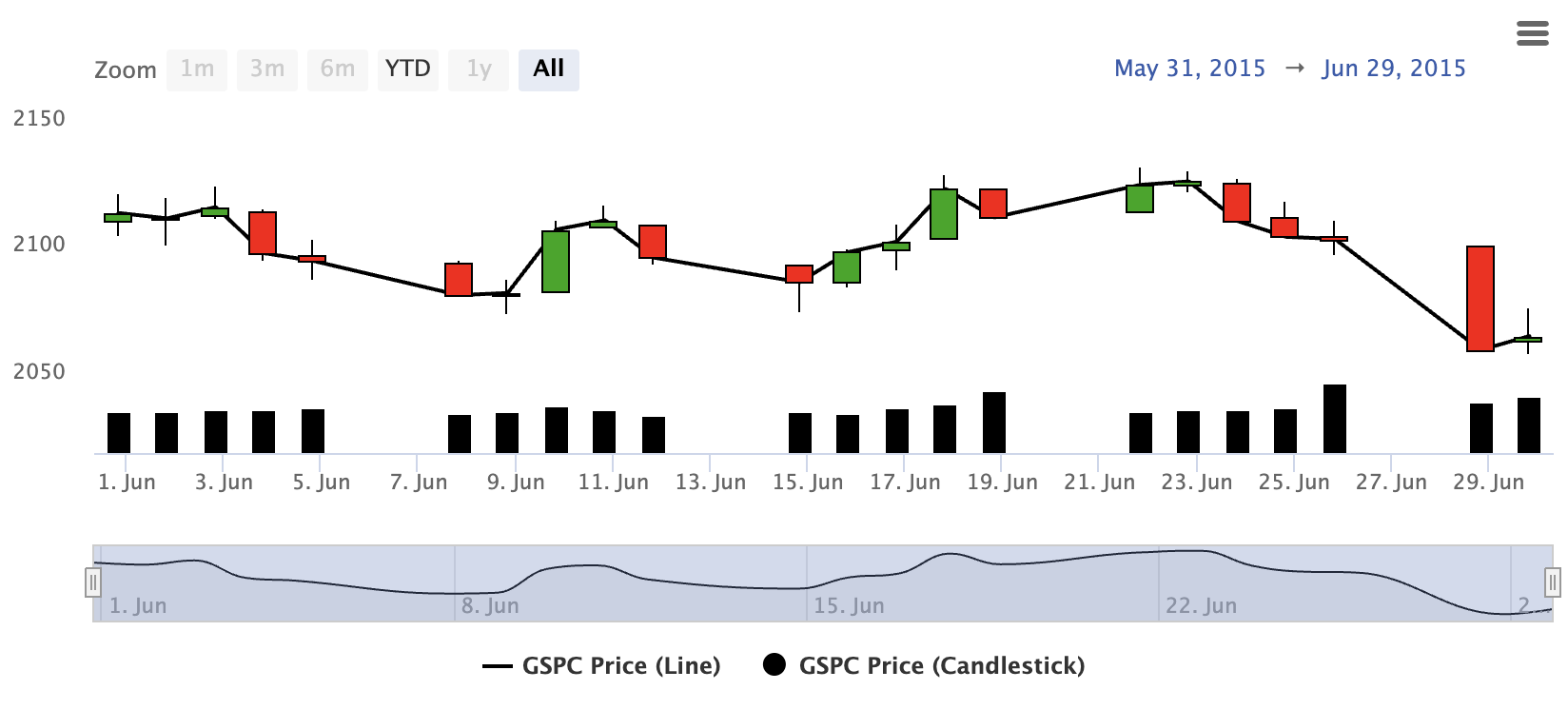

Greek Debt Crisis

Peaked on June 29, 2015

S&P down 2.1%

Bitcoin up 6%

https://www.statmuse.com/money/ask/sandp-500-chart-june-2015

https://www.statmuse.com/money/ask/sandp-500-chart-june-2015

https://www.statmuse.com/money/ask/bitcoin-chart-june-2015

https://www.statmuse.com/money/ask/bitcoin-chart-june-2015

Bitcoin up 14.3% for the month, while the S&P was down 2.2%.

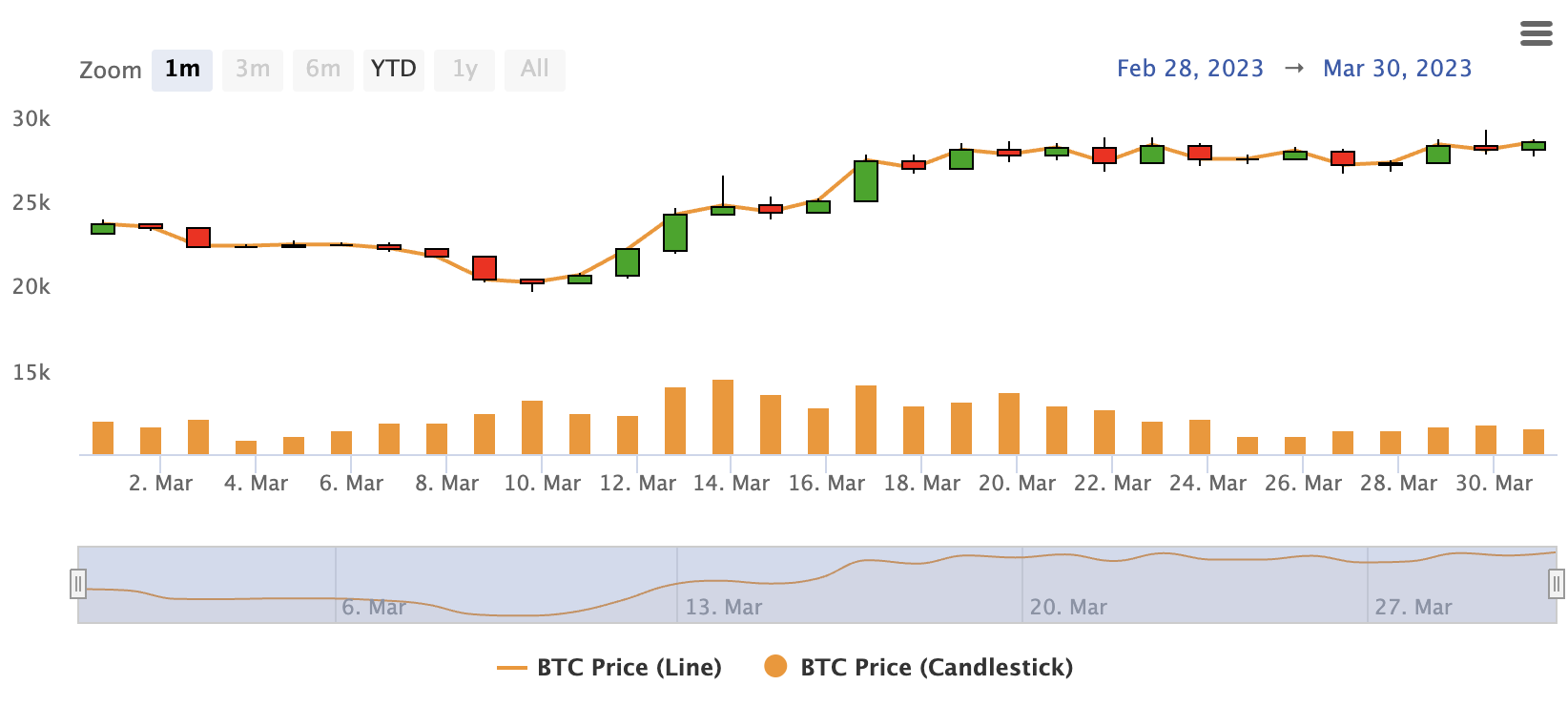

Silicon Valley Bank

Collapsed on March 10, 2023.

S&P 500 down 3.1% on March 10th

Bitcoin down 0.8% on March 10th, then markedly up in the days following: 3/11: 2.2%, 3/12: 7.4%, 3/13: 9.2%

https://www.statmuse.com/money/ask/sandp-500-chart-march-2023

https://www.statmuse.com/money/ask/sandp-500-chart-march-2023

https://www.statmuse.com/money/ask/bitcoin-chart-march-2023

https://www.statmuse.com/money/ask/bitcoin-chart-march-2023

Bitcoin up 23% for the month vs. S&P 500 up 3.7%.

April of 2025 (Reaction to Tariffs)

With all of the hubbub on Trump’s tariffs starting in early April and continuing throughout the month, Bitcoin was up 14.1% on the month, while the S&P 500 was down 0.76%.

My Thoughts

I’ve viewed bitcoin as a “risk-off” asset more than a “risk-on” asset for a while now. To me, global liquidity will continue to rise as countries have to print more money to deal with ever-expanding debt. I believe that the rate that we see bank-runs and similar-type crises will become more frequent over time as more stress is put on the system.

Bitcoin’s price may not be consistent from day-to-day, but the 200-week moving average has risen at every point in bitcoin’s history. As someone with a low time preference, that seems pretty predictable to me.

Stay Up-to-Date on All Things Bitcoin

At Crossover Capital, our number one goal is to provide people with the support, knowledge, and access to make informed decisions about their financial futures. Building a foundation for success starts with steady support and a customized approach. Crossover Capital is here to provide the necessary tools we believe are required for growth and to be a champion for our clients’ success.

Investment advisory services offered through Crossover Capital Brands, LLC (dba Crossover Capital), a Registered Investment Advisor with the U.S. Securities and Exchange Commission.

This material is intended for informational purposes only. It should not be construed as legal or tax advice, and is not intended to replace the advice of a qualified attorney or tax advisor. This information is not an offer or a solicitation to buy or sell securities. The information contained may have been compiled from third party sources, and is believed to be reliable.

Alternative investments – such as hedge funds and private equity/venture capital funds – are speculative and involve a high degree of risk. Likewise, the emergence of digital assets comes with its own speculative characteristics and involves a high degree of risk. Various digital assets have unique features, and the regulatory risk environment continues to change as governance requirements, rules, and lawsuits emerge. There may be material differences in the type of marketplaces available for digital assets, and there could be significant restrictions or limitations on withdrawing from or transferring these types of investments. Digital assets may incur higher fees when compared to traditional assets, and these expenses may offset returns.

Crossover Capital may not be able to independently verify digital asset valuations provided by institutions that hold or offer digital asset services. As a result, Crossover Capital will generally rely on information reported to it by third parties. As such, the information contained herein is for informational purposes. Clients should recognize that they may bear digital asset-based fees and expenses at the manager-level, as well as indirect fees, expenses, and performance-based compensation for digital assets. Spot bitcoin exchange-traded products were recently approved for listing and trading by the SEC. However, such approvals do not indicate SEC approval to use or invest in bitcoin. Clients should remain cautious and aware of the various risks associated with digital assets that have a value tied to bitcoin or other crypto related products.